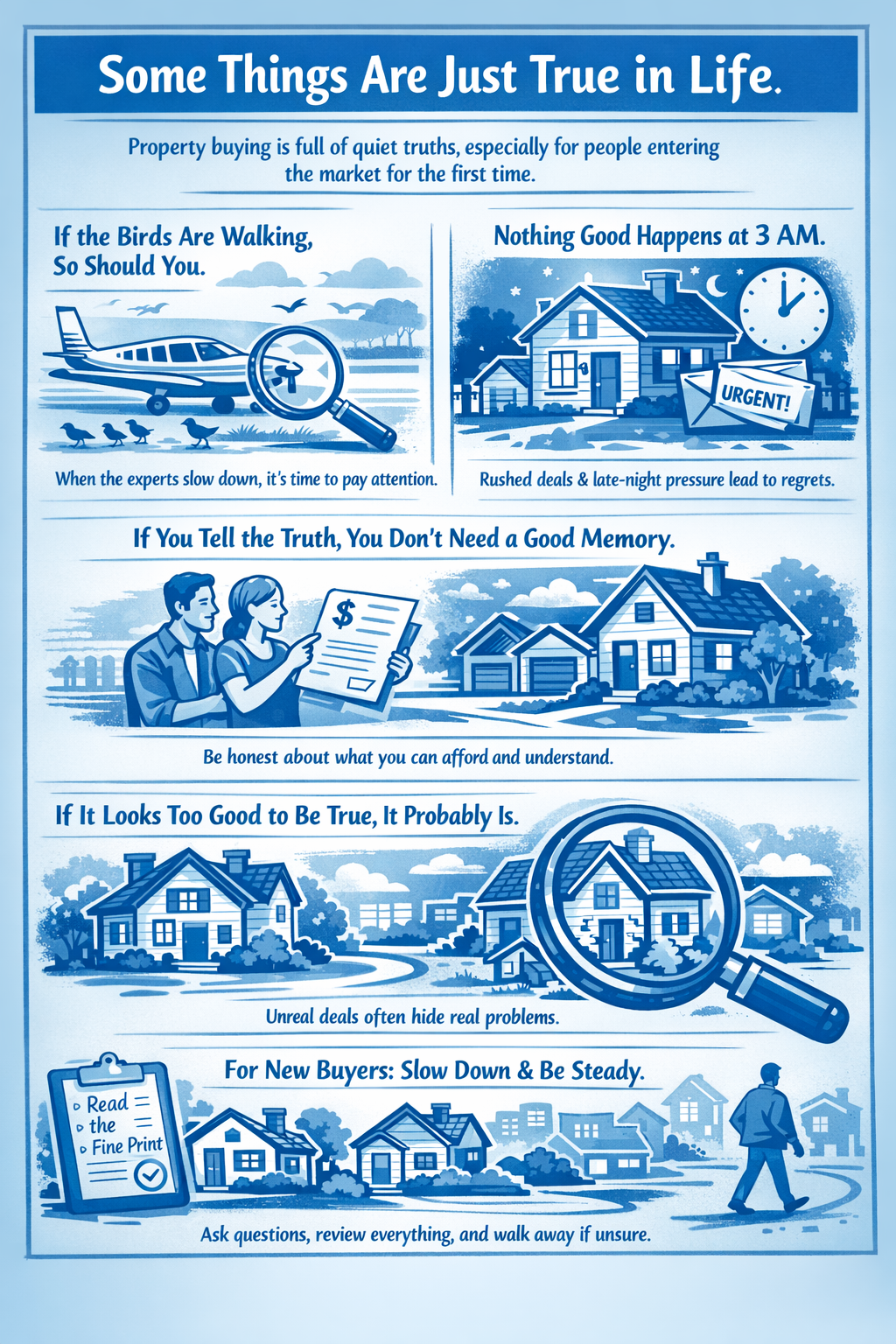

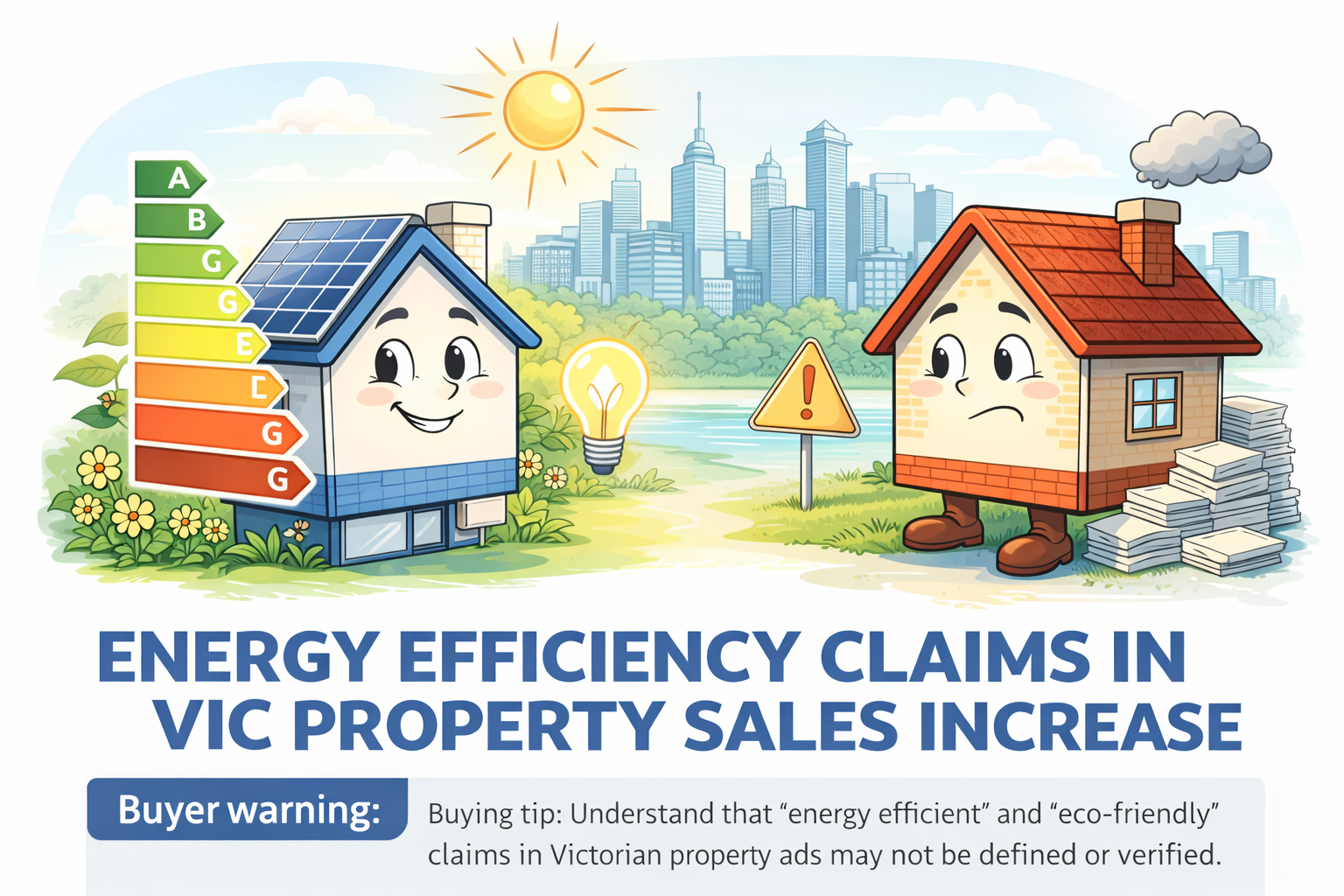

Things Agents Say That Mean Nothing

/If a real estate agent is talking, you are being sold a story. Some are harmless. Some are expensive. This article explains how to recognise sales talk, why urgency is often manufactured, and why only what is written in the contract actually matters.

Read More