Victoria Is Now Taxing A Tax. Here Is How The New Draft Duty Ruling Really Works

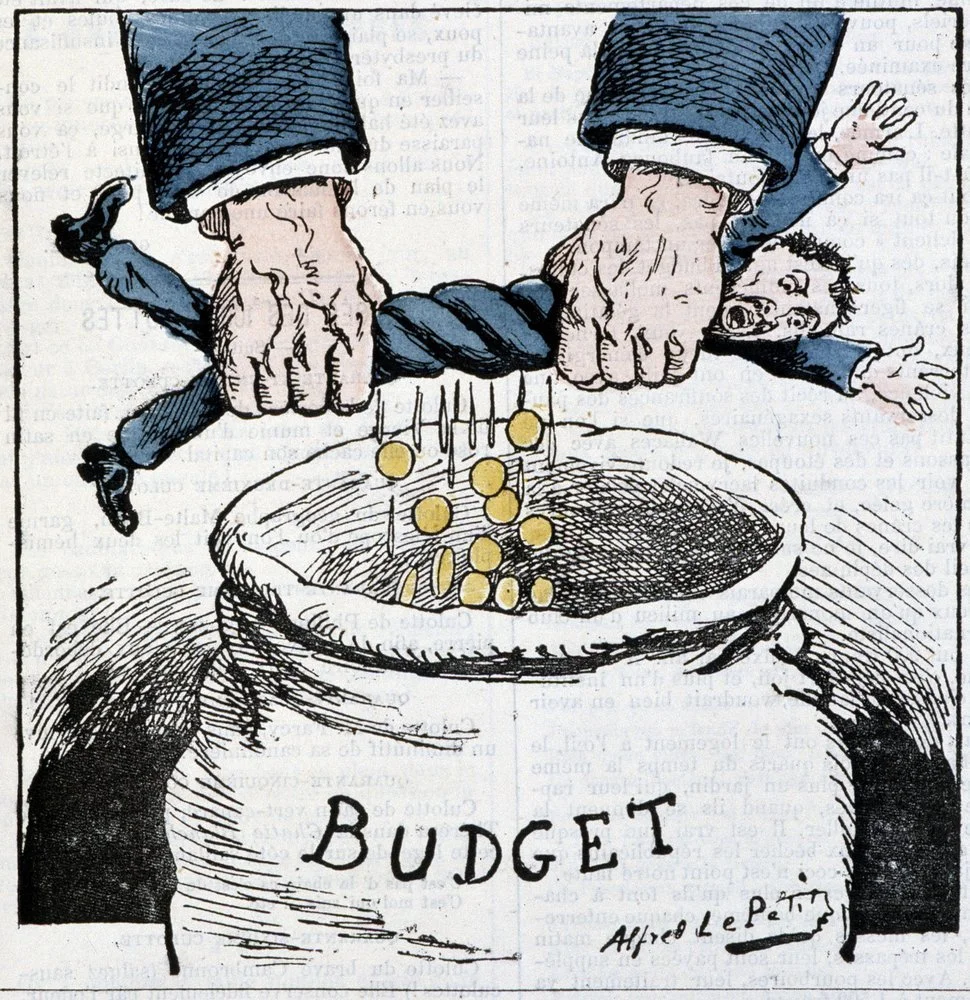

/Every time you think Victoria has finished dipping into the pockets of ordinary buyers, someone in government finds a new door to open. The latest idea coming out of the State Revenue Office is simple. If the property market is slowing, just tax something else. And if you run out of things to tax, then tax another tax. That is exactly where we are heading with Draft Ruling DA 070 under the Duties Act 2000.

On 5 December 2025 the State Revenue Office released a draft ruling that rewrites how consideration will be treated for land transfer duty. This is the amount the duty is calculated on, and under section 20 of the Duties Act it has always been based on the greater of the sale price or the unencumbered value. For decades, the industry understood that adjustments were settlement arithmetic. You pay your share of land tax or rates or levies because of timing, not because it is part of the price of the property.

The draft ruling says that is no longer the starting point. Instead, the SRO is adopting the High Court approach from Lend Lease and Melton Highway. The question now is whether the vendor would transfer the property without the extra payment. If the answer is no, then that extra payment is part of what moves the transfer. And if it moves the transfer, it is consideration. And if it is consideration, you pay duty on it.

This is the doorway that turns a land tax adjustment, a congestion levy, or even a windfall gains tax payment into something the SRO can charge duty on. It is not new legislation. It is an interpretation. But interpretations can hurt buyers just as much as Parliament when they widen the base used to calculate duty.

Here is the part that matters. Land tax is only captured where the sale price is at or above the threshold amount under section 10G of the Sale of Land Act. In 2024 that amount was ten million dollars. If the property is below the threshold, a purchaser cannot legally assume the vendor’s land tax and the ruling itself confirms that such amounts cannot be consideration. But once the price is at or above the threshold, the contract normally apportions land tax. If the contract says the purchaser must pay a specific amount of the vendor’s land tax and the vendor will not transfer the property without that payment, then it becomes consideration under the Duties Act.

Windfall gains tax is similar. If the liability exists on the day the contract is signed, section 10H of the Sale of Land Act says the purchaser cannot assume it. So it cannot be consideration. But if the tax arises after the contract is signed and the purchaser agrees in the contract to pay it and the vendor would not transfer without that payment, then it becomes consideration. The draft ruling gives a clear example. The purchaser pays the vendor’s one hundred and twenty five thousand dollar windfall gains tax assessment as part of settlement. That payment moves the transfer. That payment is consideration. Duty applies.

The congestion levy is treated the same way. If the contract says the purchaser must pay part of the vendor’s levy and the vendor will only transfer the parking spaces on that basis, then the amount is part of the dutiable value under section 20. Duty will be charged on the price plus whatever portion of levy the purchaser is picking up.

Rates remain mostly safe. Normal adjustments for the settlement period are not consideration. But if the purchaser is paying rates that relate to an earlier rating period, the ruling confirms that amount is consideration. It is a narrow point but it matters in commercial transactions.

The big picture is obvious. This is a major shift away from the long standing practical treatment of adjustments in Victoria. Adjustments have never been treated as part of the purchase price. They have always been timing mechanisms. Under this ruling, adjustments suddenly have the potential to become part of the dutiable value if they meet the test of moving the transfer.

Yes, it is still a draft. Yes, the State Revenue Office wants comments. But buyers should understand where this is heading. The more the purchaser is required to pay in connection with vendor liabilities, the more likely it is that duty will be charged on those amounts. It really is tax on a tax in certain circumstances, wrapped in a ruling that quietly slides the duty base outwards without amending the Act.

Victorian Property Settlements will monitor the progression of this draft and provide updates as the final position becomes clear. If you are about to sign a contract where high value land tax, windfall gains tax or congestion levy amounts might be involved, speak to us before you proceed so you understand the impact on duty calculations.

Victorian Property Settlements, trusted for more than twenty five years by Victorian buyers and sellers.

www.victorianpropertysettlements.com.au