Thinking About Engaging a Conveyancer? Read This First

Conveyancing fees in Victoria can vary widely, and many buyers and sellers have no idea what they're actually paying for. If you're searching "how much does a conveyancer cost?" or "conveyancing fees Victoria" – you're not alone. Let's break it down.

What Are Conveyancing Costs?

"Conveyancing costs" refer to the total amount you pay your conveyancer (or property solicitor) to handle the legal and administrative side of your property transaction. These can be split into:

Professional Service Fees – what your conveyancer charges for their time and expertise.

Disbursements – third-party charges like title searches, certificates, and settlement fees.

Government Fees and Taxes – these are outside the scope of your conveyancer’s costs but must be factored into your budget.

The total conveyancing fees Victorian clients pay typically range from $880 to $2,200 depending on complexity.

Disbursements and Out-of-Pocket Expenses

In addition to the professional fees charged by your conveyancer, there are disbursements – third-party charges that are essential to complete your transaction properly. These may include:

Title searches and property certificates

Planning and zoning checks

Water and council rate certificates

Owners corporation certificates (if applicable)

PEXA or electronic settlement platform fees

These disbursements are the out-of-pocket expenses your conveyancer pays on your behalf and are passed on to you at cost. They are not included in the advertised conveyancing fee unless clearly stated.

But that's not the end of it.

You’ll also need to allow for a range of state and federal government charges and bank-related fees, including:

Stamp duty (state tax on property transactions)

Land transfer registration fees

Electronic gateway or online lodgement fees

Mortgage registration or discharge fees (through your bank)

Bank fees for loan account payout figures or settlement attendance

And beyond the legal and registration costs, you’ll also face standard adjustments at settlement, such as:

Council rates

Water authority charges

Owners corporation (body corporate) fees (if applicable)

Land tax adjustments (where allowed)

So when you’re reviewing conveyancing quotes, remember: conveyancing fees cover the conveyance and disbursements cover your conveyancer’s out-of-pocket costs — but you still need to budget for government charges, taxes, lender fees, and settlement adjustments.

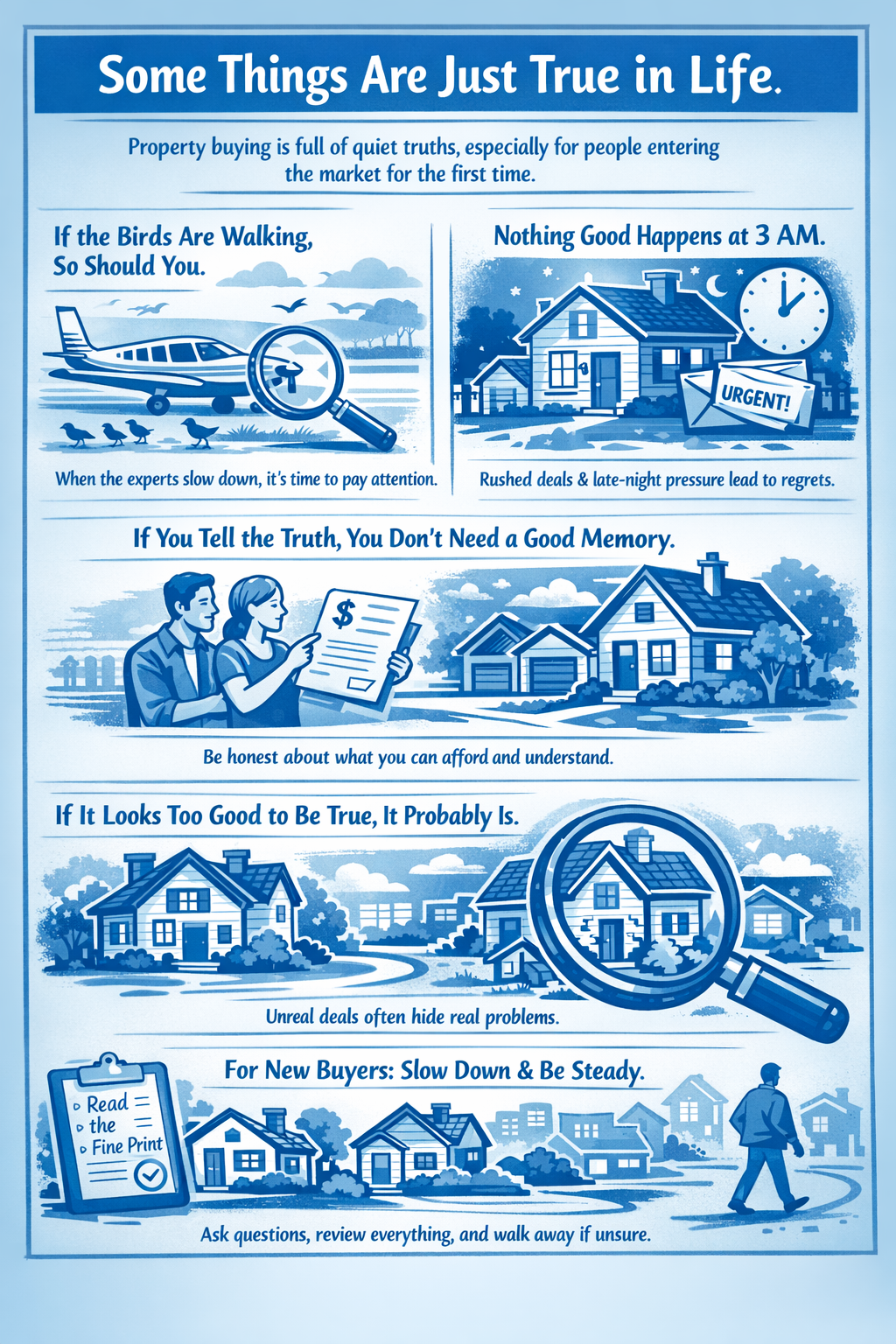

Don’t fall for the old “She’ll be right mate” quote that hides these extras. A professional conveyancer will give you a full picture upfront.

Fixed Fee Conveyancing vs Pay-As-You-Go

Fixed Fee Conveyancing

A single, upfront fee that usually covers standard tasks such as:

Reviewing your contract

Preparing settlement documents

Liaising with your lender and agent

Pros:

Easy to budget

No surprise fees (in theory)

Cons:

May exclude certain work (e.g. complex special conditions, urgent matters)

Some fixed-fee quotes hide disbursements in fine print

Pay-Per-Service (Hourly or Per-Task Billing)

Pros:

Transparent itemisation of costs

You only pay for what you need

Cons:

Unpredictable final bill

Can be more expensive for complex transactions

What to Ask When Comparing Quotes

To ensure you're not being misled:

What’s included in the fee? – Ask if contract reviews, certificates, and settlement attendance are part of the quote.

How much do I need to pay upfront? – Is a deposit required? When is the balance due?

How will I be billed? – In stages? At settlement? Is there a cancellation fee?

What happens if the deal falls through? – Will you be charged for partial services?

Are disbursements included or separate? – Make sure you’re not hit with $300+ in extras unexpectedly.

What Should I Expect to Pay in Victoria?

In 2025, most conveyancing fees Victoria wide fall into these brackets:

Straightforward Sale or Purchase: $880 – $1,500 (inc. GST)

With Caveats, Trusts, or SMSFs: $1,500 – $2,200

Off-the-Plan or Commercial Property: $2,200+

Typical disbursements add $300–$500 to these amounts.

At Victorian Property Settlements, we offer transparent, fixed-fee pricing with no hidden surprises. Our clients always know what's included.

What If My Transaction Falls Through?

It happens – finance fails, buyers get cold feet, or inspections go wrong. But what does that mean for your conveyancing costs?

Most firms will charge you only for the work completed up to that point. But some still charge a flat fee regardless. Ask up front: “If the contract is terminated, what do I owe?”

Final Tip: Ask for a Written Breakdown

A professional conveyancer should always provide a written quote clearly outlining:

Professional fees

Disbursements

GST

Timing of payments

If the quote is vague or lacks detail – walk away.

Get an Accurate Conveyancing Quote Now

Need a conveyancer you can trust in Victoria?

Victorian Property Settlements – Trusted for over 25 years by Victorian buyers and sellers.

✅ Transparent pricing

✅ Fixed fees with detailed quotes

✅ SMSF and complex transactions welcome

Visit www.victorianpropertysettlements.com.au to request a quote today.

See our recent article - Conveyancing fees don't get caught